Connect with Us! 📞 (502)-381-5075 📧 [email protected]

Free Medical Collections Dispute Letter!

If you have any medical collections or charge offs, this is a good way to get them removed and restore your credit score!

We will not rent, sell, or share your information.

Personal Credit: What is personal credit and how does it work?

Having bad credit can affect every area of your life, especially when it comes to your finances! Just one derogatory item can cost you thousands of dollars when financing a car, a home, getting a personal loan, or credit cards.

Bad personal Credit could even prevent you from being able to get approved for insurance or utilities!

How does Consumer Credit work?

Consumer Credit (or personal credit) is based on a numerical scoring system. It ranges from 300 - 850. There are 3 Consumer Credit reporting agencies that monitor payment history.

Each one of these Consumer Credit Reporting agencies generate a credit score based on multitude of variable criteria. The list is as follows:

- Payment history. Payment history is the most important ingredient in credit scoring, and even one missed payment can have a negative impact on your score. Lenders want to be sure that you will pay back your debt, and on time, when they are considering you for new credit. Payment history accounts for 35% of your FICO® Score☉ , the credit score used by 90% of top lenders.

- Amounts owed. Your credit usage, particularly as represented by your credit utilization ratio, is the next most important factor in your credit scores. You credit utilization ratio is calculated by dividing the total revolving credit you are currently using by the total of all your revolving credit limits. This ratio looks at how much of your available credit you're utilizing and can give a snapshot of how reliant you are on non-cash funds. Using more than 30% of your available credit is a negative to creditors. Credit utilization accounts for 30% of your FICO® Score.

- Credit history length. How long you've held credit accounts makes up 15% of your FICO® Score. This includes the age of your oldest credit account, the age of your newest credit account and the average age of all your accounts. Generally, the longer your credit history, the higher your credit scores.

- Credit Mix. People with top credit scores often carry a diverse portfolio of credit accounts, which might include a car loan, credit card, student loan, mortgage or other credit products. Credit scoring models consider the types of accounts and how many of each you have as an indication of how well you manage a wide range of credit products. Credit mix accounts for 10% of your FICO® Score.

- New credit. The number of credit accounts you've recently opened, as well as the number of hard inquiries lenders make when you apply for credit, accounts for 10% of your FICO® Score. Too many accounts or inquiries can indicate increased risk, and as such can hurt your credit score.

Click here to check my credit score.

Speak with an Expert Now

Custom Personal Credit Evaluation ($249 Value!)

Consumer Credit Scoring Models

To make things even more confusing, there are multiple scoring models.

The credit score you find online probably isn’t the same number the auto lender sees when you apply to finance a new vehicle. It isn’t the same as the score a mortgage lender or credit card issuer might see either. In fact, a credit score check in each of these situations might come back with significantly different results.

A credit score you find online may differ from the score a lender uses for several reasons. First, three different credit bureaus (Equifax, TransUnion and Experian) maintain your credit reports. So, if you check a credit score based on your Equifax credit report but a lender checks a score based on your TransUnion report, the numbers won’t match. Another contributing factor is the fact that there’s more than one credit score brand.

In the U.S., most credit scores are created either by FICO or VantageScore Solutions. And while there are many similarities in how FICO Scores and VantageScore credit scores work, there are some noteworthy differences too.

Similarities Between FICO Scores and VantageScore

A credit score is a snapshot evaluation of your credit risk at a given point in time. It can help lenders judge whether loaning you money is a wise investment. Since both FICO and VantageScore credit scores serve this same purpose, it shouldn’t be surprising that they share a number of features.

Credit Score Range

FICO Scores range from 300 to 850. At first, VantageScore credit scores featured a different numerical scale (501 to 990). However, VantageScore 3.0 and 4.0 adopted the same 300 to 850 scale that FICO uses.

With both FICO and VantageScore models, higher scores are better. Higher scores make it easier to qualify for financing and to receive competitive financing offers from lenders. In fact, the lifetime value of a good credit score could save you tens or even hundreds of thousands of dollars.

Design Objective

Credit score creators design their scoring models to do a specific job. This job is known as the scoring model’s stated design objective. Both FICO and VantageScore credit scores share the same stated design objective. They can predict the likelihood that a consumer will pay any credit obligation 90 days late or worse within the two years.

When you have a higher credit score it means you’re less likely to pay your bills severely late (90 days or more after the due date) in the near future (the next 24 months). A lower credit score signals the opposite.

Credit Score Factors

Your credit scores, regardless of the brand, are influenced by similar factors. These details include information like your payment history, credit utilization ratio, the age of your accounts, mixture of account types and more.

All of the factors which cause your credit score to move up or down are found on your credit reports. Information outside of your credit reports has no direct impact on your scores. This fact is true whether those numbers are calculated by a FICO or a VantageScore credit scoring model.

ECOA Compliance

Before a lender can use a credit score to evaluate applicants, the scoring model must pass a few tests. Specifically, it has to satisfy a federal law known as the Equal Credit Opportunity Act (ECOA).

The ECOA states that credit scores used for lending purposes in the U.S. must be empirically derived, demonstrably and statistically sound. Those terms mean that credit scores in the U.S. need to be built using a proven, scientific method (aka empirically derived). And they have to work (aka demonstrably and statistically sound).

A credit score is supposed to predict the likelihood that someone will pay a bill 90 or more days late in the upcoming 24 months. So, FICO and VantageScore Solutions have to prove that each credit scoring model they build does what it’s designed to do.

Differences Between FICO Scores and VantageScore

Despite the fact that FICO Scores and VantageScores serve a similar purpose, they aren’t identical. You can think of them like the Pepsi and Coca Cola of the financial world. Below are a few key differences between the two credit score brands.

Founders

FICO and VantageScore Solutions are two competing companies. Each one creates and sells credit scores to lenders and other businesses in the financial industry.

FICO is a publicly traded company based in California. The analytics company was founded in 1956 by an engineer, Bill Fair, and a mathematician, Earl Isaac. VantageScore Solutions, based in Connecticut, was jointly founded by Equifax, TransUnion and Experian in 2006.

Minimum Scoring Criteria

Not everyone is eligible for a credit score. In order to receive one, your credit report must first satisfy a scoring models’ minimum criteria.

To qualify a FICO Score, your credit report needs to display a tradeline (e.g., credit card, loan, line of credit, etc.) that’s a minimum of six months old. And at least one tradeline on your report must show some activity in the last six months.

Qualifying for a VantageScore is a little easier. Your credit report simply needs at least one tradeline present, regardless of the age of that account.

If you don’t have a credit card, other types of payments may qualify. A service like Experian Boost may help ensure you have every opportunity to build a credit profile.

Points Value

A credit scoring model looks over your credit report and awards you a certain number of points based on the information it finds. You can earn points for each factor the scoring model considers (e.g., payment history, credit utilization, length of credit history, credit inquiries, etc.). For example, a credit report with zero late payments would be worth X number of points to be added to your overall score.

FICO and VantageScore models assign different values (or weights) to the items they find on your credit report. Your delinquency-free credit report might earn you 150 points toward your FICO Score. But that same report with no late payments might net you 155 points under a VantageScore scoring model. These point values are purely hypothetical, but they do reflect the way credit scores work.

Credit Score Values

As mentioned, FICO Scores and VantageScore credit scores share the same range of 300 to 850. Higher scores indicate less risk. But the way lenders interpret the two types of scores may not be identical.

The definition of a good credit score can vary from lender to lender. It may also differ based on the credit score brand. For example, a 670 FICO Score might be high enough to qualify for a credit card with ABC Bank. But you might need a 680 VantageScore credit score for a different credit card issuer to approve your application.

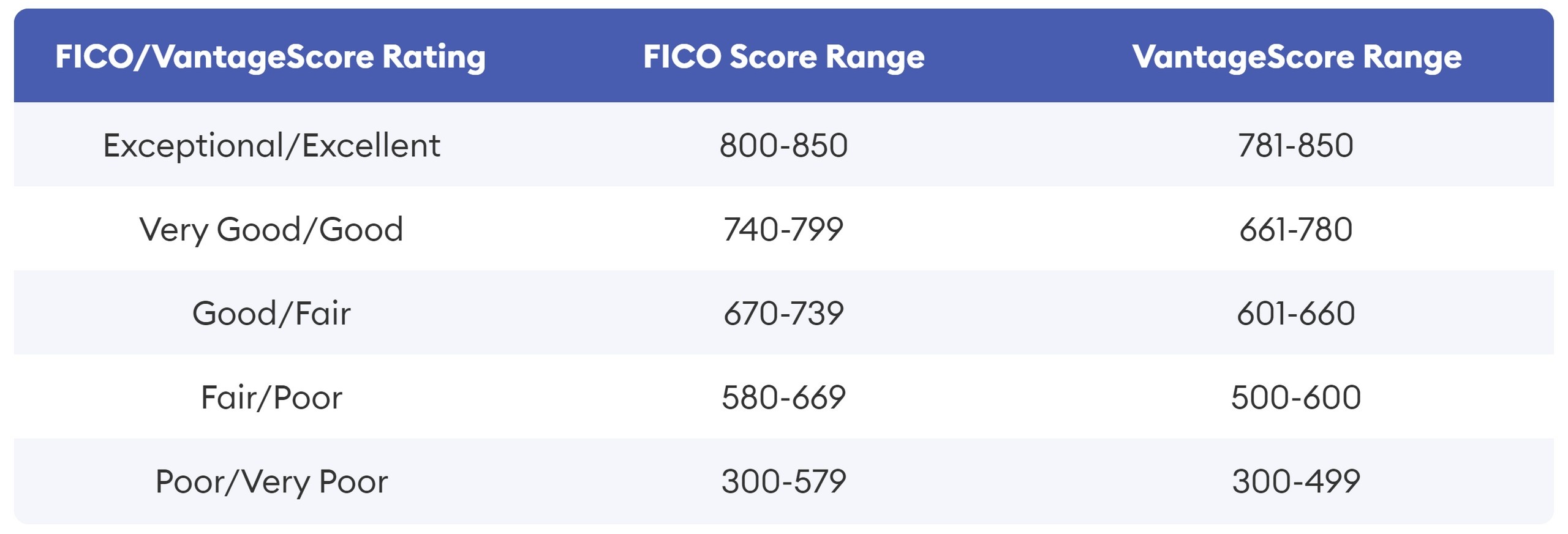

The chart below is a general guide to show how your FICO Score or VantageScore credit score might rank.