Connect with Us! 📞 (502)-381-5075 📧 [email protected]

Find out if my business qualifies for Employee Retention Tax Credit Now!

Set up a call now to see if you qualify!

$999 Application Fee waived for next 99 Business Owners!

(Must opt in and confirm appointment to waive application fee). We do not rent, sell, or share your information.

The Employee Retention Tax Credit is a reward to business owners for retaining their employees!

IMPORTANT REMINDER: Even if you got both PPP Loans... businesses are STILL qualifying and receiving sizable ERTC refunds. Apply Today!

*Refer to the Employee Retention Credit under Section 2301 of the Coronavirus Aid, Relief, and Economic Security Act Notice 2021-20

Submit Secure ApplicationDON'T WAIT UNTIL FUNDS RUN OUT!

The Employee Retention Tax Credit

Maximizing Your Claims For Keeping Americans Employed

The government has authorized unprecedented stimulus, and yet billions of dollars will go unclaimed.

Funded by the CARES Act

Originally created to encourage businesses to keep employees on the payroll as they navigate the unprecedented effects of COVID-19.

While funds are available

No Restrictions - No Repayment

This is not a loan.

While the ERTC was created in the CARES act along with the PPP Loans - this is not a loan, there is no repayment. There are no restrictions for what recipients of the credit must use the funds.

Access Financial Relief Now!

Up to $26,000 Per W-2 Employee

Full Time and Part Time Employees Qualify.

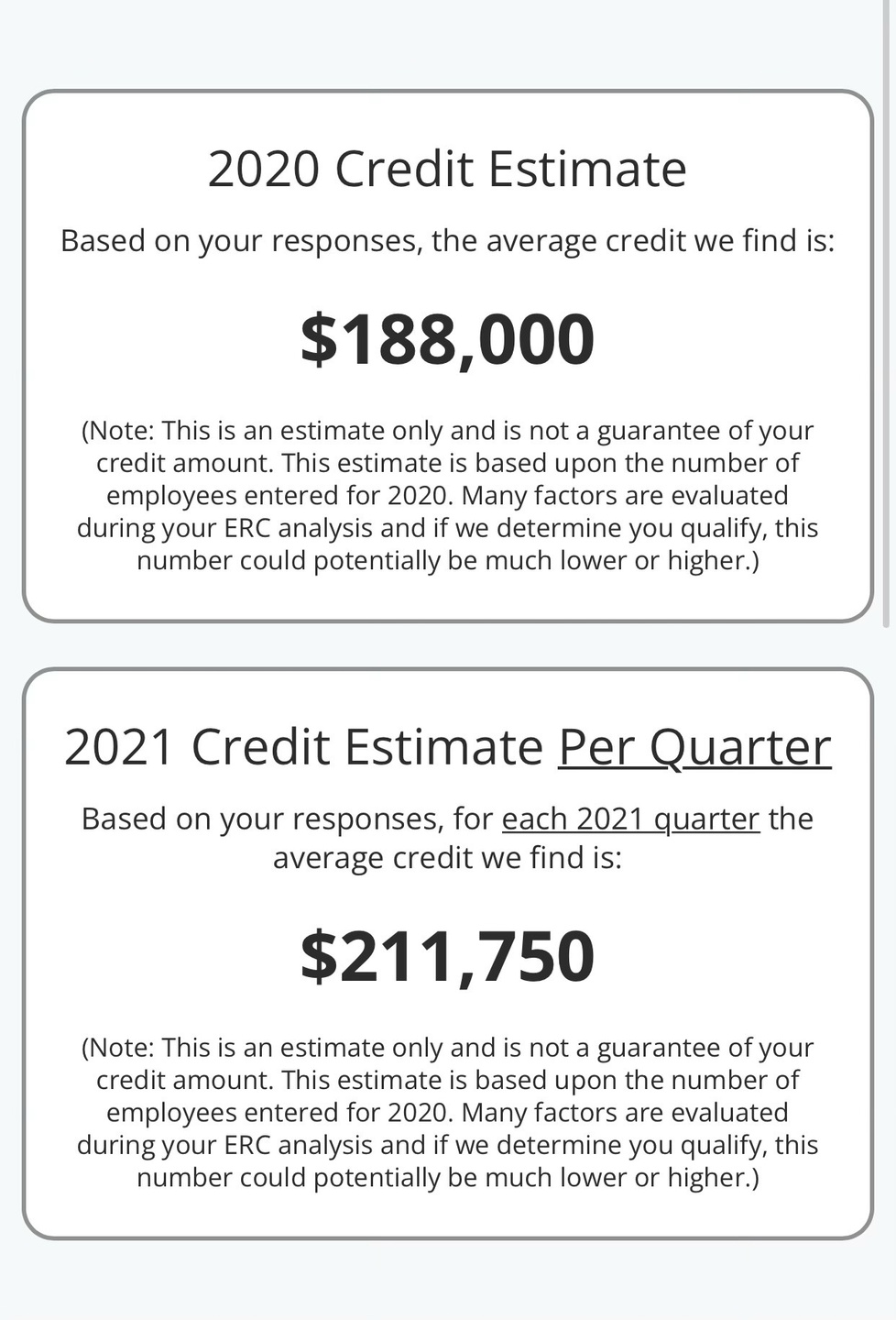

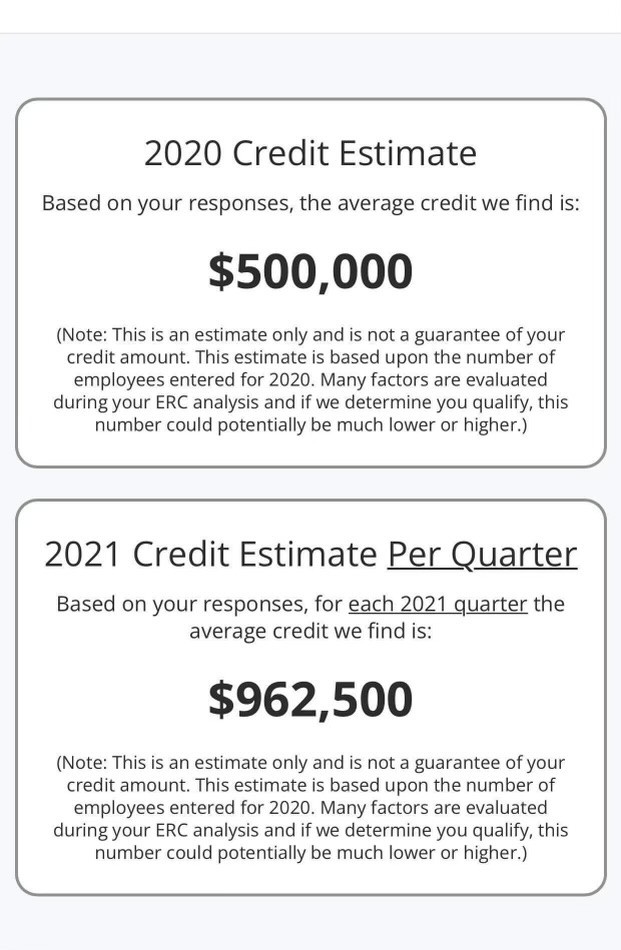

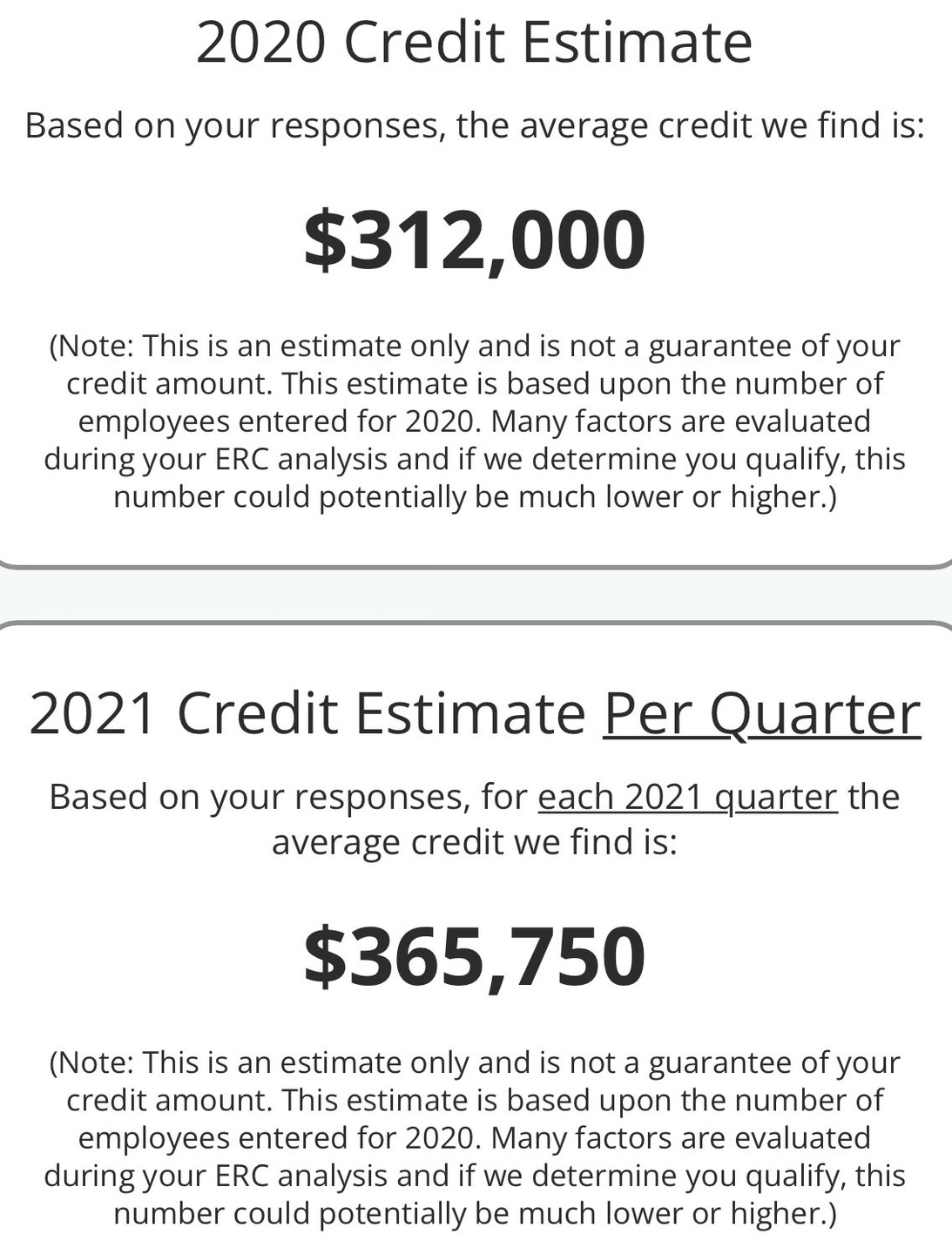

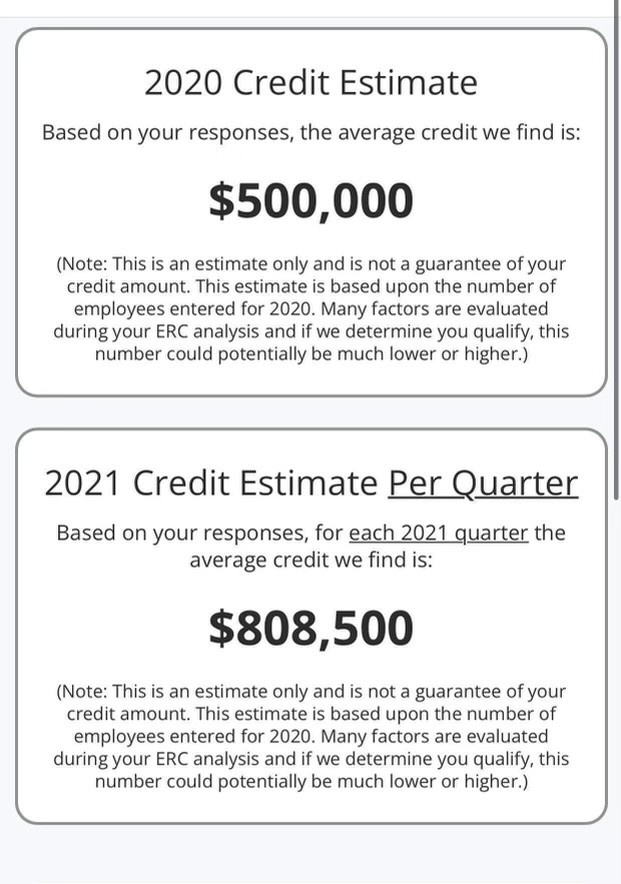

The ERTC program is a refundable tax credit for business owners in 2020 and 2021. In 2020, a credit is available up to $5,000 per employee from 3/12/20-12/31/20 by an eligible employer. That is a potential of up to $5,000 per employee. In 2021 the ERC increased to $7,000 paid per employee per quarter for Q1, Q2, and Q3. That is a potential of up to $26,000 per employee.

Start-up businesses who began operations after February 15, 2020 can take a credit of up to $50,000 in both the third and fourth quarters of 2021 for a maximum credit of $100,000.

Tax Credit Estimates

Employee Retention Tax Credit Application

The Government has set aside $400 Billion Dollars of Covid Relief through the Cares Act.

💯Free Enrollment, fast and easy form

Minimum Requirements:

-

Experienced a 20% Reduction in business

-

Your business experienced a partial or total shutdown during 2020 or 2021 (includes being limited by commerce, inability to travel, or restricted group meetings).