Connect with Us! 📞 (502)-381-5075 📧 [email protected]

Build Real Business Credit Now that Reports to your Business EIN (Tax ID Number).

Social Security Number not required!

It's no secret, that getting the best rates on personal loans or consumer credit cards is achieved by having a strong personal credit profile!

We take that same logic and apply it to your business! Regardless of the shape of your personal credit, we help you develop your business credit profile.

The Corporate Credit Enhancement Package will teach you how to build an A+ Business Credit Profile with a proven method completed by thousands of small business owners. It's extremely difficult to bankroll a business with a personal credit profile. Let us teach you how to limit that liability to your business and gain 10's of thousands of dollars in approvals through our process without having to personally guarantee any of it!

Business Funding Firm will teach you:

- How to properly structure your business

- Create a Corporate Credit Profile with an Excellent reporting history to all the Major Business Credit Bureaus

- Get Guaranteed Business Credit Approvals

- Establish Business Creditability without a personal Gurantee

Business Funding Firm will teach you how to set your business up properly to meet lender requirements. Financial institutions want to give your business credit as long as the risk is mitigated. We incorporate that extensive industry knowledge gained from decades of experience and paint them a masterpiece with your Business Credit Profile!

Types of Business Credit Available:

- Net/Vendor Accounts - Did you bid a job and want to put your supplies on credit until you get paid?

- Store Accounts - Most national retailers are available!

- Revolving Credit Card Accounts - Need cash access but don't want to personally guarantee a credit card?

- Vehicle Financing -Great for company vehicles and tax breaks. New 18 wheeler accounts available also!

- Merchant Cash Advances and Equipment Leasing available with approved accounts!

Business Funding Firm has a proven method of gaining access to non-personally guaranteed accounts by taking a systematic approach to building Corporate Credit.

Unlike Personal Credit, not all Corporate Credit accounts report to the business credit bureaus. We utilize the accounts that do report. So if you're business is using credit accounts, your getting credit and actively developing your business credit profile!

Credit Bureaus we Develop

Dun & Bradstreet

All good business credit starts with establishing a Paydex score through Dun & Bradstreet. A Dun & Bradstreet number is free to establish, but when you set it up on there website, they will try and sale you their Credit Signal Package. You do not need to pay Dun & Bradstreet for credit Reporting. Reporting is arranged by vendors who have an agreement with Dun & Bradstreet. With our Corporate Credit Enhancement Package, we not only can establish your D-U-N-S Number, but we will also provide you with accounts that report to Dun & Bradstreet to help you develop your Paydex Score!

Experian Business

Similar to personal credit reporting, Experian Business maintains controversially the most prominent business credit profile. Unlike personal credit, not all business credit accounts report to the major business credit bureaus. At Business Funding Firm, we are aware of the corporate credit accounts that report to Experian Business (same with Dun & Bradstreet and Equifax), and we utilize those accounts to help you develop your Experian Business Credit Profile!

Equifax Business

Another credit bureau that may sound familiar is Equifax Business. Equifax Business, similar to Experian business also reports both borrowed and payment transactions from key vendors. This credit profile is necessary, and developing this business credit history will complete your A+ Business Credit profile. With the Corporate Credit Enhancement Package, we know who these key vendors are, and we help you develop a relationship with them to evenly distribute your business credit history.

Understanding Business Credit

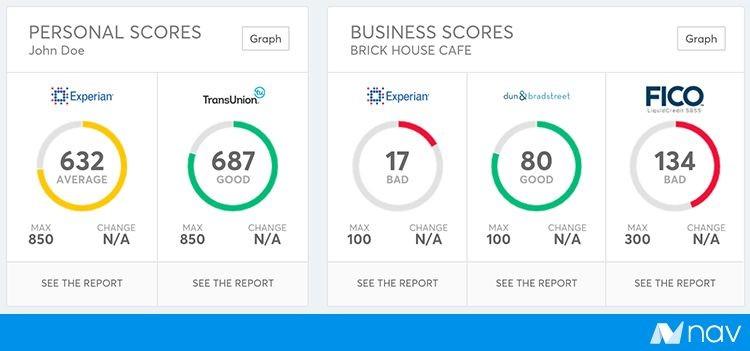

Pictured in the chart above is a combination credit score with consumer and commercial credit profiles accessed through Nav.com.

In order to understand Business Credit, we must first understand Personal Credit.

Personal Credit

To the left are two basic consumer credit scores. When you request a line of credit through a vendor: whether it is a bank, a credit card, a home, or a vehicle; these items will report to one or multiple consumer credit bureaus (Experian, Equifax, and Trans Union), identified by and attached to your social security number.

Business Credit

Business Credit is similar. Instead of reporting to a social security number, Business Credit is reported to an EIN (Employer Identification Number) aka Tax ID Number.

The difference is, Business Credit is Public information (meaning anyone can access it by purchasing a report) and not all accounts report. For example, you may have 12 Corporate Credit accounts, but may not have credit established to generate a credit report.

To Check your Corporate Credit Score Click the Link below.

Once an account is created, click Upgrade and enter code epic-month for a free month so you can download your Corporate Credit Report for Free!

What we do

Over the course of the years, we noticed a huge gap in knowledge in the credit industry involving Business Credit so we decided to do something about it!

Business Funding Firm has created a simple yet comprehensive road map that helps Business Owners like yourself gain access to the funding they need!

Let's face it, financial institutions aren't lining up to hand out money to small businesses! It's constantly getting harder to get approvals, and the requirements make it virtually impossible for small businesses to meet.

What we found, is the ability to mitigate lender risk by developing a strong corporate credit profile by accessing accounts that report and leveraging good payment history!

With our Business Credit Course, we show you exactly how to create an A+ Business Credit Profile, by gaining access to dozens of business credit accounts! All of the accounts we utilize report to at least one of the major Business Credit Bureaus and most provide access to large lines of credit! This includes but is not limited to: Net and Vendor Accounts, Fleet Fuel Cards, Store Accounts, Online accounts, Revolving Credit Card Accounts, and Corporate Fleet Financing accounts, all without the use of personal credit!

Does My Business Qualify?

Simple application that will allow us to immediately qualify your business for funding!

Start Application!